Secure Your Wallets From Illicit Funds

Receiving funds of illegal origin could lead the risk of having your funds frozen

Suspicious Transactions

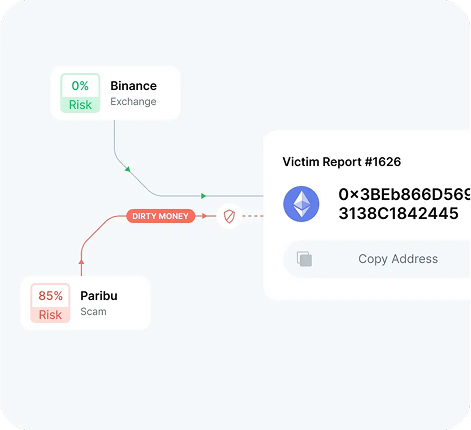

Identifying assets linked to illegal activities such as fraud, terrorism, extortion, and other crimes.

Investigations

View the direct and indirect connection between the given address and the identified clusters, the total value sent to/from the target wallet, and the distance to it.

Address Tracking

Real-time monitoring of any transactions associated with a specified blockchain address, receiving instant notifications for both incoming and outgoing transactions.

23% of wallets hold risky assets, exposing users to scams, fraud, or bad actors.

AMLBot risk scoring is based on multiple data sources, ensuring that we have the most reliable data in the industry

Keep Your Crypto Safe

Identify Potential RisksBoost Security

Identify and address potential security threats to safeguard your investments and holdings.

Avoid CEX Account Suspension

Regular verification of your crypto walletsand transactions can significantly reduce the risk of your assets being frozen onexchanges.

What do we analyze?

Staying compliant with evolving regulatory standards is crucial in the cryptocurrency world. Regular checks help you adhere to legal requirements, avoiding penalties and legal issues.Child Exploitation

Entities associated with child exploitation.Dark Market

Coins associated with illegal activities.Dark Service

Coins related to child abuse, terrorist financing or drug trafficking.Enforcement action

The entity is subject to legal proceedings with the judicial authorities.Fraudulent Exchange

Exchanges involved in exit scams, illegal behavior, orwhose funds have been confiscated by government authorities.Gambling

Coins associated with unlicensed online gamesIllegal Service

Coins associated with illegal activities.Mixer

Coins that passed via a mixer to make tracking difficult or impossible. Mixers are mainly used for money laundering.Ransom

Coins obtained by extortion or blackmail.Sanctions

Entities subject to sanctions.Scam

Coins that were obtained by deception.Stolen Coins

Coins obtained by stealing someone else's cryptocurrency.Terrorism Financing

Entities associated with terrorism financing.ATM

Coins obtained via cryptocurrency ATM operator.Exchange | High Risk

An entity becomes high-risk based on the following criteria:No KYC: does not require any customer information before allowing any level of deposit/withdrawal, or makes no attempt to verify that information.

Criminal Ties: Criminal charges against the legal entity in connection with AML/CFT violations.

Impact: High exposure to risky services such as darknet markets, other high-risk exchanges, or mixing is defined as a service whose direct high-risk exposure differs by one standard deviation from the average of all identified exchanges over a 12-month period.

Jurisdiction: based in a jurisdiction with weak AML/CFT measures.

Unlicensed: does not have any specific license to trade cryptocurrencies.

Liquidity Pools

The smart contracts where tokens are locked for the purpose of providing liquidity.P2P Exchange | High Risk

The entity does not have any special license to conduct and provide cryptocurrency exchange services, when participants exchange directly with each other, without intermediaries.It also includes entities that are licensed but located in listed jurisdictions, are listed as non-cooperating companies by the FATF, or do not provide KYC for large-value transactions, making them attractive for money laundering.

Unnamed Service

The category refers to currently unidentified clusters that exhibit the behavior expected of a service, by a large number of addresses and transactions.Exchange

The organization allows users to buy, sell and trade cryptocurrencies with trading licenses that include the following aspects of services: —Depository, brokerage or other related financial services that provide exchange services where participants interact with a central party.And it does not include: — Licenses for non-specific financial services and jurisdictions included in the FATF non-cooperative list.

They represent the most important and most used category of entities in the cryptocurrency industry, accounting for 90% of all funds sent via these services.

ICO

The organization that crowdfunds its project by selling their newly minted cryptocurrency to investors in exchange for fiat currency or more common cryptocurrencies such as Bitcoin and Ether.There are many legitimate examples of these offerings, but also there are many cases where bad actors raise funds via ICOs, then they take the money and disappear.

Marketplace

Coins that were used to pay for legal activitiesMerchant Services

The entity that allows businesses to accept payments from their customers, also known as payment gateways or payment processors.It often faciliates conversions to local fiat currency and transferring the funds into the merchant's bank account.

Miner

Coins mined by miners and not forwarded yet.Other

Coins obtained through airdrops, token sales or other means.P2P Exchange

The entity is licensed to conduct a business that is specific to providing cryptocurrency exchange services where participants exchange directly with each other, without intermediaries.It does not include non-specific financial services licenses and jurisdictions that are on the non-cooperative FATF list.

Payment Management

Coins related to payment services.Seized Assets

Crypto assets seized by the government.Wallet

Online Wallet is a service used for storing and transacting cryptocurrency. Hosted wallets, a type of online wallet, are custodial solutions where the service holds the user's private keys, posing potential risks of scams or insufficient security, though reputable providers may offer better security than non-expert individuals.Why AMLBot?

Personalized Approach

- AMLBot offers a wide range of compliance solutions customized for each client.

- We're confident in meeting your demands after helping 300+ crypto enterprises of all sizes in 25 jurisdictions

Integrated Compliance Platform

- We offer KYT/Wallet Screening, KYC, AML, and more for crypto businesses

- AMLBot' risk scoring is based on multiple data sources, ensuring that we have the most reliable data in the industry

- Our user-friendly services and solutions streamline your company processes, removing compliance provider complexity

Pricing

10 Checks

10 Checks

25+ Supported Blockchains and their native assets and tokens

25+ Supported Blockchains and their native assets and tokens

Manual checking of transactions and wallet sthrough the dashboard

Manual checking of transactions and wallet sthrough the dashboard

24/7 Priority Service

24/7 Priority Service

Secure Your Crypto with Wallet & Transaction Risk Screening

Meet the core team

Frequently Asked Questions

In addition, the check result may include various optional information about the address, such as belonging to the cluster, actual balance, and transferred funds amount.

The check result may be incomplete in relation to the described data if the necessary information is missing.

Please note that for blockchains that are in the limited mode, clustering and percentage value of the check risk score are not available. A risk score can be provided for a counterparty only if it relates to an entity.

AMLBot finds connections of a checked address to other addresses on the blockchain and with entities of different categories, each with a different conditional risk score, and calculates the overall risk score based on those connections.

The overall risk score calculation takes into account the risk severity of connections found. For example, in the case of connections to entity categories Mining (0% risk) and Darknet (100% risk), the risk impact of Darknet, as a more risky category, will be higher, and Mining will have less weight in the risk assessment.

The AML check shows the connections of the checked address to these entity categories as the sources of risk, with which the address interacted, and the percentage of funds transferred from/to these services.

Based on all the sources of risk, an overall risk score is calculated, which helps the user to make further decisions about the assets.

A transaction check process differs from the address check, and the result depends on your side in the transaction. The overall risk score always relates to the counterparty.

To check a transaction you need to specify the TxID and the destination address of the transaction and select your side in the transaction:

- Recipient (you got a deposit to your wallet) - the addresses from which the funds were received are checked. The sources of risk describe the services from which the TX senders accumulated the transferred funds with a percentage breakdown.

- Sender (you made a withdrawal from your wallet) - the wallet that received the funds is checked. The sources of risk describe all connections of the recipient address with a percentage breakdown.

Thus, when checking a transaction, the risks for the recipient are checked if you receive funds, and the risks for the sender if you send funds.

- 0-25% is a clean wallet/transaction;

- 25-75% is the average level of risk;

- 75%+ such a wallet/transaction is considered risky.

It is also worth paying attention to the red sources of risk in the detailed analysis, described in page

If the check shows that your assets had no connection with illegal activity and the service blocked you, you can provide the saved result to confirm the purity of your assets.

• up to 10 minutes if the payment was made within 24 hours after the invoice was issued,

• up to 25 minutes if the payment was made after 24 hours after the invoice issuance. Overall, BTC, ETH, USDT, and fiat are processed faster than other cryptocurrencies.

If you purchased checks with a time limit - they will be deducted from your account after expiration date.

Our ISO 9001 certification highlights our commitment to delivering consistent quality and enhancing customer satisfaction. More crucially, our ISO 27001 certification demonstrates our dedication to maintaining high standards of information security, ensuring the protection of sensitive data, and achieving regulatory compliance.

Learn more about our certifications here.